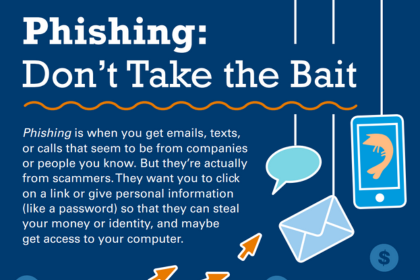

Scams are dishonest schemes that aim to trick you into giving away your money or personal information. Scammers use various tactics to lure you into their traps, such as phishing scams by phone, text or email. Phishing is when someone pretends to be a legitimate organization or person and asks you to provide sensitive information, such as your bank account number, online banking credentials, or one-time passcodes. They may also try to get you to click on a link that leads to a fake website that looks like the real one, where they can steal your login credentials or install malware on your device.

One of the ways scammers can make their phishing attempts more convincing is by using phone spoofing. Phone spoofing is when someone alters the caller ID to make it appear as if they are calling from a trusted number, such as your bank, the IRS, or a government agency. They may claim that there is a problem with your account, that you owe money, or that you are eligible for a refund or prize and will often pressure you to act quickly to avoid legal action.

However, you should never give out your bank information over phone, text or email, no matter how urgent or official the message sounds. BankGloucester will never ask you for your account information or security codes in this way. If you receive a suspicious call, text or email, do not respond or click on any links. Instead, play it safe and call the bank directly at 978-283-8200 to verify the authenticity of the communication. You can also report the scam to the Federal Trade Commission (FTC).

Scams can cause serious financial and emotional harm, especially to more vulnerable groups like the elderly. It’s important to be aware of the common signs of scams, and how to protect yourself from them.

Here are some tips to help you avoid falling victim to fraud:

Remember, if something feels off, it probably is. By being vigilant and cautious, you can protect yourself and your loved ones from scams and fraud. For more information, visit: